$180 M

Predatory lending fees saved

$240 M

USPS & Fed workers lent money

4.5k+

5-star reviews

6+

Years of operation

The current system undervalues Federal & USPS employees.

45% of

USPS & Feds workers can't access money when they need it.

65% approx.

Employees face periodic wage freezes or minimal paycheck raises.

70% of

Federal and USPS employees with bad credit can't access bank or credit union loans.

People also search 👉

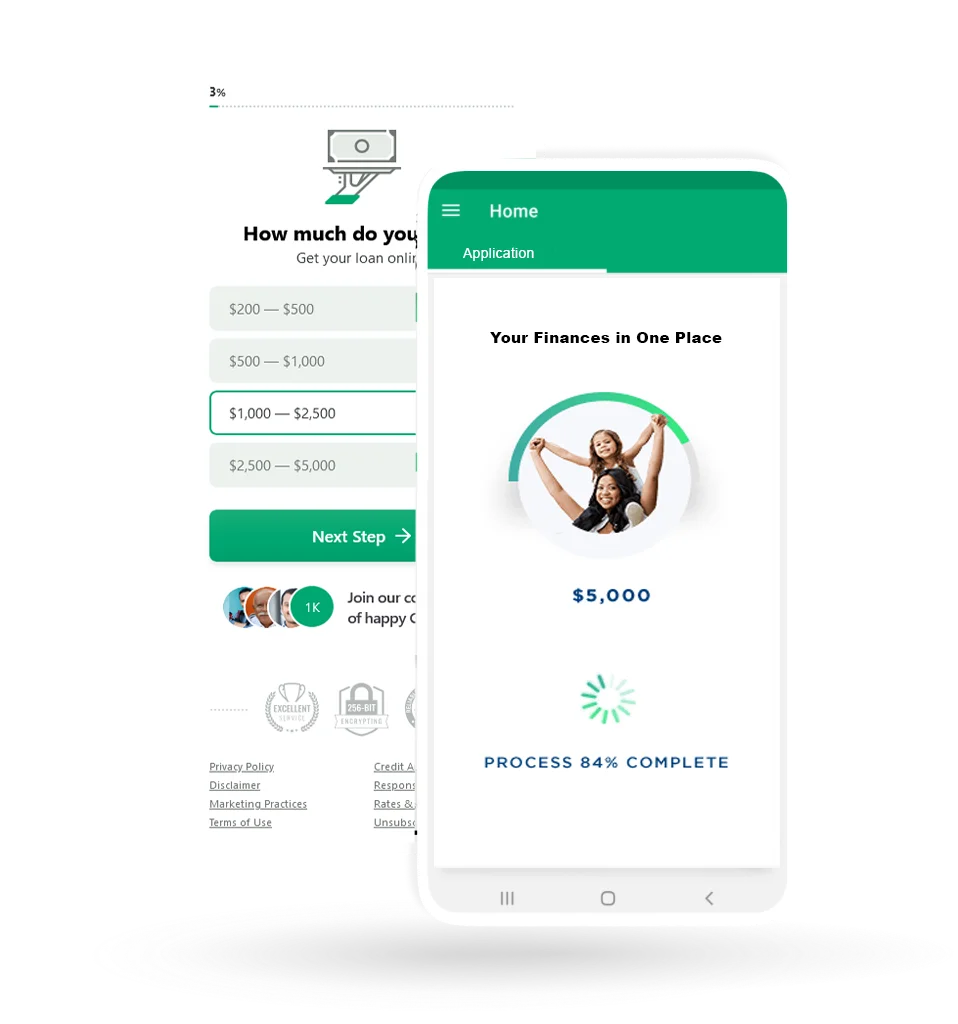

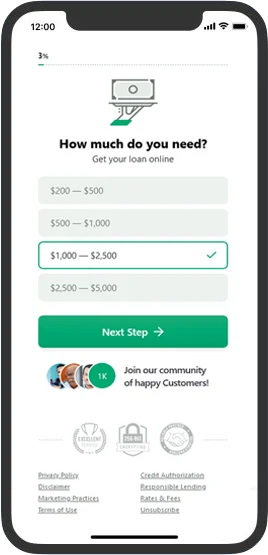

How CreditsBox Works?

We know that our Federal and USPS employees are hardworking and may need to access funds quickly. To fulfill this mission, we designed our application process to be as simple and fast as possible.

Apply Online

Fill out our online, short, and secure form and search an industry-leading panel of lenders to find the best USPS or Feds loans.

Check Your Offer

Once you get a loan offer from the lender, you can review it thoroughly and get your cash.

Get Your Money

Once accepted, your money will be directly deposited into your bank account within 10 minutes.

We've only Partnered with the best in the Business

CreditsBox chooses highly reputable direct lenders to help with USPS & Fed's financial needs.

Borrow $100 - $5,000 Today

Our mission at CreditsBox is to help our hardworking Feds & USPS employees lead a richer and stress-free life.

CreditsBox is a leading and dedicated short-term personal loan provider for government employees, including Federal and USPS workers. You can apply paperless for up to $5,000 in minutes, and once approved, cash is deposited into your account in 10 minutes*, even on weekends.

When life throws you a curveball it's CreditsBox to the rescue.

Have bad credit but need cash fast? CreditsBox offers loans for Federal and USPS employees, even with bad credit. There is no credit check, no hidden fees or early repayment charges—just pure financial help on time when you need it.

What Our Customers Say?

We do our best to provide you the best experience ever.

Really fast and a great process for those who need this service. I would definitely recommend doing business with creditsbox!

Chris, TX

Very helpful and friendly people. They will make sure you are appreciated for being a loyal customer. Highly recommended.

Jenniffer Mohal, UT

Convenient, straightforward, honest. Does it cost to borrow, yes, but they are quick when you need some quick funds. It's hard to pay off early, that is my only grievance.

Annabelle, KY

I highly recommend CreditsBox, it is my go-to when I need money, it easy simple and very sufficient and it's all from your phone also love the cash back idea!!!

Bessie Kouroupis, CA

Such a great company for emergency loans for federal employees, they have great website to apply online and everything is fast and easy.

Behdad Ziaei, AL

This company has been a lifesaver for my husband and I!when our fridge broke we had no options and when we borrowed we were able to pay it back easier.i love that it's there anytime we need it.customer service is always prompt and very kind.

Aunya and rick, GA

You guys are extremely helpful, very quick and don't know any other company who works this fast!! Highly recommend it to postal or federal workers in need!

Anna, MI

I love this service. It has been very accommodating and is a wonderful service to people who may need it.

Margaret Sheppard, ND

Really fast and a great process for those who need this service. I would definitely recommend doing business with creditsbox!

Chris, TX

Very helpful and friendly people. They will make sure you are appreciated for being a loyal customer. Highly recommended.

Jenniffer Mohal, UT

Convenient, straightforward, honest. Does it cost to borrow, yes, but they are quick when you need some quick funds. It's hard to pay off early, that is my only grievance.

Annabelle, KY

I highly recommend CreditsBox, it is my go-to when I need money, it easy simple and very sufficient and it's all from your phone also love the cash back idea!!!

Bessie Kouroupis, CA

Such a great company for emergency loans for federal employees, they have great website to apply online and everything is fast and easy.

Behdad Ziaei, AL

This company has been a lifesaver for my husband and I!when our fridge broke we had no options and when we borrowed we were able to pay it back easier.i love that it's there anytime we need it.customer service is always prompt and very kind.

Aunya and rick, GA

We're real people, and we're here to help!

Simple, Stress-Free Way to Borrow Money for USPS and Federal

Whether your paycheck is delayed, you have an unexpected bill, or you want to consolidate your existing debt, give yourself a little break and apply now with the best lenders dedicated to USPS and Federal employees.

Apply Now – No Credit Needed!

Have a Question?

We Have The Answer!