When the banks say NO, Give us a GO!

Fast Enough

If your loan is approved, cash is directly sent to your bank in under 10 minutes. Timing depends on your banking processing.

No Early Repayment Fees

Repay in 3-6-12 monthly instalments without stressing your budget. We don't charge early repayment fees.

Apply 24/7

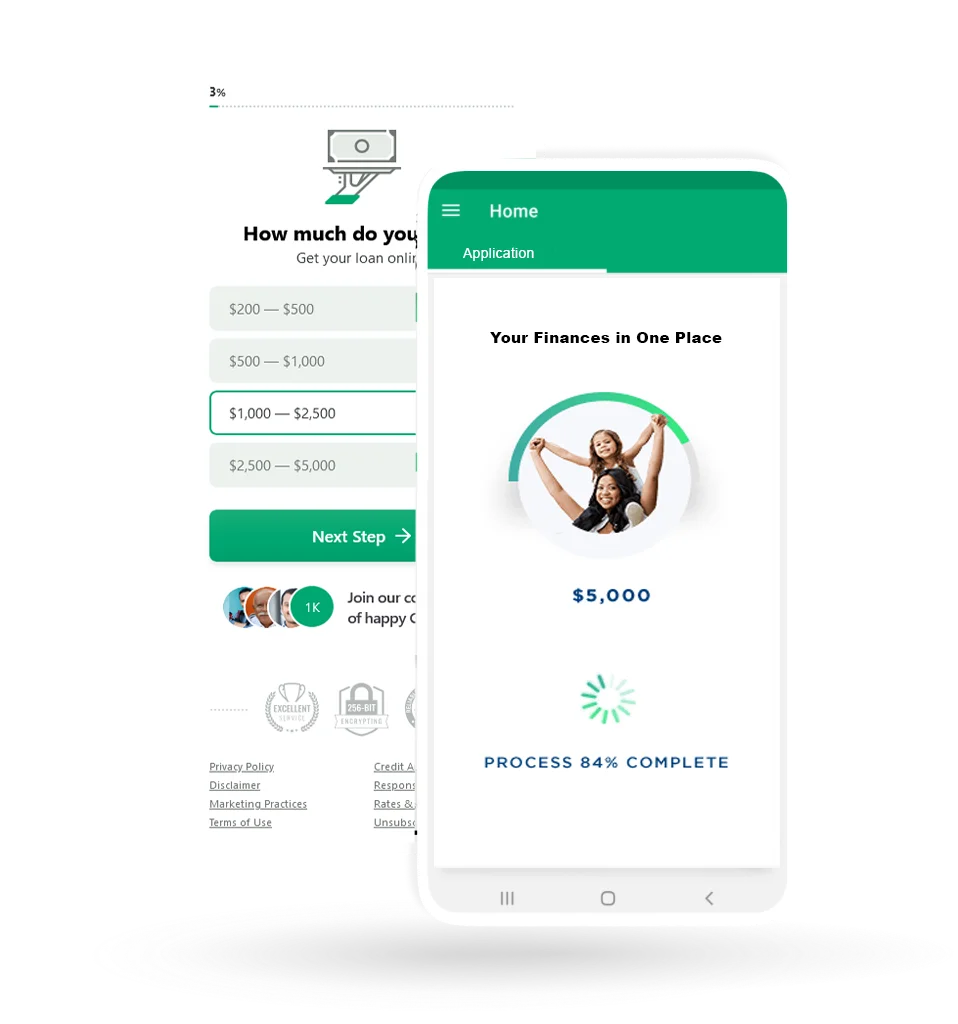

You can apply via our secure and online application available 24/7. Get decisions and funding in a few minutes, not hours or days.

What are $100 dollar loans for USPS and Federal employees?

$100 dollar loans are small loans provided exclusively for our mates working in USPS and Federal departments. We know they have credit unions and other options to borrow money, but they are slow and require a lot of paperwork. They won't serve you better in financial emergencies.

So, 100 dollar loans are short-term personal loans usually settled over a short term, often the next payroll deposit, or two or three weeks or months, as stated in the loan terms. Unlike USPS, Federal credit union, or bank loans, $100 loans are easier for government employees to approve due to their small amount and steady income involvement.

You can borrow $100 for the temporary money problems you have, such as urgent pending bills, car repairs, or medical emergencies. But keep in mind that $100 short-term loans can come with high rates and fees.

How do I check if I'm eligible for a $100 dollar loan?

If you want to know if you are eligible for a $100 dollar loan as a USPS or Federal worker with CreditsBox, you need to match the following first:

- Be a U.S. citizen or permanent resident.

- Be at least 18 years old.

- Working for USPS or Federal.

- Have an active bank account.

- Have enough monthly income to repay the loan.

During the application process, your lender might ask you to show proof of income. It is true that government employees earn a steady income, but as a responsible lender, they just ensure that you can comfortably repay the loan on the agreed date.

What can a quick $100 loan be used for?

Financial emergencies strike everyone whether you work for USPS postal or Federal departments. In such situations, a quick 100 dollar loan can be used for any valid purpose. You may use it to cover cash shortages like urgent car repairs, house renovation, medical bills, etc. In most cases, USPS and Feds workers apply for a $100 loan for short-term financial support or to bridge the financial gap until the next paycheck.

For whatever reason you need money, an instant $100 dollar loan can offer you super flexibility in times of emergencies. However, it is important to keep in mind that such loans require quick repayment and could be more expensive than other credit options.

What if my $100 dollar loan application is rejected?

There is no guaranteed $100 loan application approval, and it might be declined, but not to panic. There are many other reasons behind the rejection of loans. These can be included:

- Very bad credit score or having defaulted history of repaying past loans.

- Incomplete information or errors in the application form.

- Unable to match the eligibility criteria, like being unable to repay the loan on time.

- High debt-to-income ratio.

If your loan application is rejected, try to understand the reasons behind it. If you submit inaccurate information, then correct them. Ask directly to your lender about the exact reason behind the rejection.

As a USPS or Federal employee, can I get a $100 dollar loan today?

Absolutely yes! Getting a $100 loan today is possible with CreditsBox. You can apply for a fast $100 dollar loan the same day from our direct and responsible lenders that provide both instant decision and funding. Once your loan is approved, the loan amount is directly deposited into your bank account. Depending on the lender you choose, it usually takes 10-15 minutes*.

At CreditsBox, USPS and Federal employees can apply for as little as $100 and up to $5,000 by filling out an online application form. There's no need to go through lengthy paperwork, and unlike traditional banks, you get a decision within 2-5 minutes.

Frequently Asked Questions

Can I borrow $100 loan with bad credit?

Yes, you can borrow a $100 dollar loan with bad credit. Many lenders allow people with bad credit to qualify for a loan. Usually, they focus more on the borrower's income and ability to repay, and USPS and Federal employees have both. They'll mainly want to check if you can repay the loan on time without difficulties.

Is it possible to get $100 dollar loan with no credit check?

Yes, but options are limited and expensive. Some lenders offer short-term $100 loans without traditional credit checks on the borrower file. Such loans are offered at very high interest rates and additional fees. Before applying, ensure you can afford the repayments.

Can I get a $100 dollar payday loan?

Yes, you can apply for $100 dollar payday loans. Typically, payday loans are the best option for short-term financial emergencies. USPS and Federal workers who need urgent money can borrow up to $2,500 and repay it on the next payday.

Can I payback the 100 loan early?

Yes, you can pay back your $100 loan early without paying any extra charge for early repayment. We recommend repaying your loan earlier, if possible, to save some on your interest.